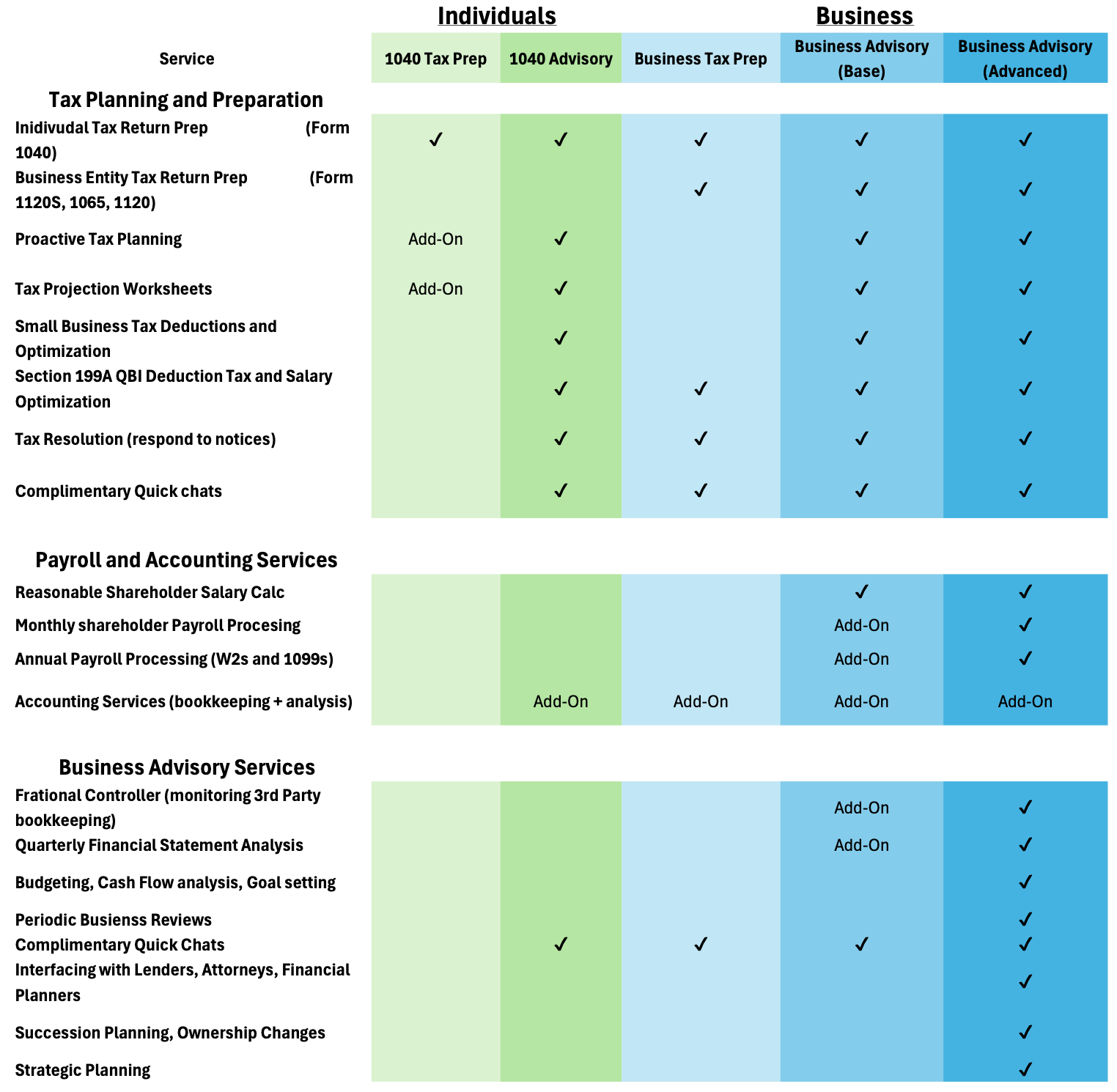

Tax Preparation & Planning

Navigating taxes can be overwhelming, especially with today’s complex regulations. We make it simple, ensuring you don’t miss out on any deductions or credits while planning for a stronger financial future. Whether you need help filing your return or strategizing for long-term tax savings, our personalized approach has you covered.

Simplify Your Taxes. Maximize Your Savings.

From simplifying the filing process to creating long-term strategies for growth, we’re here to handle the details so you can focus on what matters most.

Customized Tax-Saving Strategies

BOokkeeping Support

Comprehensive Tax Filing

For Individuals

Filing Done Right, Every Time

Preparing your tax return can leave you with more questions than answers. Even simple returns are subject to today’s ever-changing tax laws, which can make the process feel overwhelming. At McCusker Associates, we take the guesswork out of filing, ensuring your return is accurate, compliant, and optimized for savings. Here's what we provide:

1040 Tax Return Preparation

What You Get:

- Preparation of Form 1040 for individuals with straightforward tax situations.

- Includes up to 5-6 standard tax documents (e.g., W-2s, 1098s, 1099-INT, etc.).

- Schedule A deductions (medical, taxes, mortgage interest, charity).

- Dependent/childcare credits and IRA/529 contributions.

- One state tax return.

Who It’s For:

- Individuals with simple tax needs who want professional preparation.

- Ideal for those who don’t require complex tax planning or advisory services.

1040 Advisory Services

What You Get:

- Proactive tax planning and strategy throughout the year.

- Tax projection worksheets to estimate liabilities and avoid surprises.

- Estimated tax payment calculations.

- Complimentary consultations for quick questions.

- IRS audit defense for returns prepared by the firm.

Who It’s For:

- High-net-worth individuals, rental property owners, and those with complex tax

- situations.

- Individuals who want to minimize tax liabilities and maximize wealth through strategic

- planning.

For BUSINESSES

Proactive Strategies for Lasting Savings

Successful tax planning doesn’t happen at the end of the year – it’s a year-round effort. At McCusker Associates, we go beyond tax compliance, working with you to develop a proactive plan that minimizes your tax liability and helps you achieve your financial goals. Whether you’re looking to preserve assets, reduce income taxes, or optimize retirement distributions, we’ll create a strategy tailored to your needs. Here's what we offer:

Business Tax Return and Individual Tax Preparation

What You Get:

- Preparation of business tax returns (Forms 1120S, 1065).

- Individual tax return preparation (Form 1040) for one owner.

- Proactive tax planning and strategy, including tax projection worksheets.

- Complimentary consultations for quick questions.

Who It’s For:

- Small business owners who want integrated tax preparation for both their business and

- personal finances.

- Business owners seeking to optimize tax strategies for their entity and personal returns.

Let’s Take the Stress Out of Your Finances.

When you work with McCusker Associates, you’re not just hiring an accountant – you’re gaining a partner dedicated to your financial success. Let us help you simplify, strategize, and save.